Blank Transfer-on-Death Deed Form for the State of Indiana

Indiana Transfer-on-Death Deed Sample

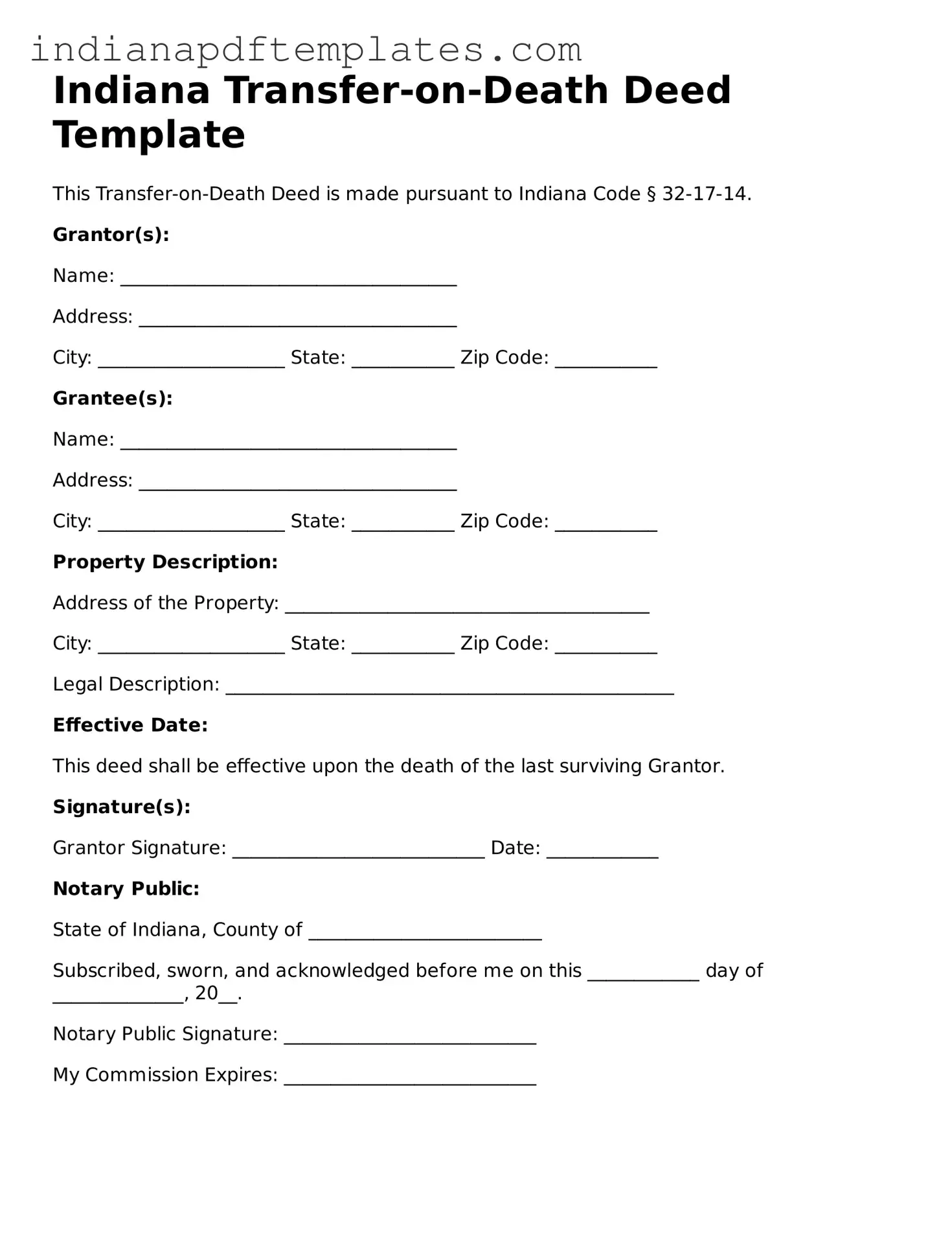

Indiana Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to Indiana Code § 32-17-14.

Grantor(s):

Name: ____________________________________

Address: __________________________________

City: ____________________ State: ___________ Zip Code: ___________

Grantee(s):

Name: ____________________________________

Address: __________________________________

City: ____________________ State: ___________ Zip Code: ___________

Property Description:

Address of the Property: _______________________________________

City: ____________________ State: ___________ Zip Code: ___________

Legal Description: ________________________________________________

Effective Date:

This deed shall be effective upon the death of the last surviving Grantor.

Signature(s):

Grantor Signature: ___________________________ Date: ____________

Notary Public:

State of Indiana, County of _________________________

Subscribed, sworn, and acknowledged before me on this ____________ day of ______________, 20__.

Notary Public Signature: ___________________________

My Commission Expires: ___________________________

PDF Properties

| Fact Name | Description |

|---|---|

| Definition | An Indiana Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Indiana Transfer-on-Death Deed is governed by Indiana Code § 32-17-14. |

| Eligibility | Any individual who owns real estate in Indiana can create a Transfer-on-Death Deed. |

| Beneficiaries | Property owners can designate one or more beneficiaries to receive the property upon their death. |

| Revocation | Property owners can revoke the deed at any time before their death, provided they follow the proper procedures. |

| Execution Requirements | The deed must be signed by the property owner and notarized to be valid. |

| Filing | The deed must be recorded with the county recorder's office where the property is located to be effective. |

| Tax Implications | Transfer-on-Death Deeds do not trigger gift taxes during the property owner's lifetime. |

| Limitations | The deed cannot be used for all types of property, such as personal property or property held in a trust. |

Essential Points on This Form

What is a Transfer-on-Death Deed in Indiana?

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners in Indiana to transfer their real estate to designated beneficiaries upon their death. This type of deed enables the property to pass outside of the probate process, simplifying the transfer for heirs. The property remains under the owner's control during their lifetime, and they can revoke or modify the deed at any time before their death.

Who can create a Transfer-on-Death Deed?

Any individual who owns real estate in Indiana can create a Transfer-on-Death Deed. This includes homeowners, landowners, and individuals with property interests. However, it is essential that the person creating the deed is of sound mind and legally capable of making such decisions.

How do I complete a Transfer-on-Death Deed?

To complete a Transfer-on-Death Deed, follow these steps:

- Obtain the appropriate form, which can often be found online or through legal resources.

- Fill out the form with the necessary information, including the property description and the names of the beneficiaries.

- Sign the deed in the presence of a notary public to ensure it is legally binding.

- File the completed deed with the county recorder's office where the property is located.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do so, you must create a new deed that either modifies the existing one or explicitly revokes it. It is crucial to file the new or revocation deed with the county recorder to ensure that the changes are legally recognized.

What are the benefits of using a Transfer-on-Death Deed?

There are several benefits to using a Transfer-on-Death Deed:

- Avoids Probate: The property transfers directly to the beneficiaries without going through probate, saving time and costs.

- Retains Control: The property owner maintains full control over the property during their lifetime.

- Flexibility: The owner can change beneficiaries or revoke the deed at any time.

Are there any limitations to a Transfer-on-Death Deed?

Yes, there are some limitations to consider. A Transfer-on-Death Deed can only be used for real estate, not personal property or financial accounts. Additionally, if there are outstanding debts or liens on the property, creditors may still have claims against the property even after the transfer. It is advisable to consult with a legal professional to understand how these factors may affect your situation.

Is it necessary to hire a lawyer to create a Transfer-on-Death Deed?

While it is not legally required to hire a lawyer to create a Transfer-on-Death Deed, doing so can be beneficial. An attorney can provide guidance on the process, ensure that the deed is completed correctly, and help address any specific concerns related to your property or beneficiaries. This can help prevent potential legal issues in the future.

Misconceptions

Understanding the Indiana Transfer-on-Death Deed can help individuals make informed decisions about their property. However, several misconceptions exist regarding this legal tool. Here are nine common misunderstandings:

-

It automatically transfers property upon death.

Many believe that the Transfer-on-Death Deed immediately transfers property to the designated beneficiary upon the owner’s death. In reality, the transfer only occurs after the owner passes away, and the deed must be properly executed and recorded.

-

It can be used for any type of property.

Some individuals think the Transfer-on-Death Deed applies to all property types. However, it is specifically designed for real estate and does not extend to personal property or financial accounts.

-

Beneficiaries can access the property before the owner's death.

There is a common belief that beneficiaries can take control of the property while the owner is still alive. This is incorrect; the owner retains full control and rights to the property until death.

-

It eliminates the need for a will.

Some people assume that using a Transfer-on-Death Deed negates the need for a will. In fact, having both can provide a more comprehensive estate plan, as a will can address other assets not covered by the deed.

-

All debts are automatically cleared upon death.

There is a misconception that property transferred via a Transfer-on-Death Deed is free from the deceased's debts. However, creditors may still have claims against the estate, and beneficiaries may need to address those debts.

-

It requires the consent of the beneficiary.

Many believe that beneficiaries must agree to the Transfer-on-Death Deed for it to be valid. In truth, the owner can designate beneficiaries without their prior knowledge or consent.

-

It is a complicated process.

Some individuals think that creating a Transfer-on-Death Deed is overly complicated. In reality, the process can be straightforward if the necessary forms are correctly filled out and filed with the appropriate county office.

-

Once established, it cannot be changed.

There is a belief that once a Transfer-on-Death Deed is created, it cannot be modified. In fact, the owner can revoke or change the deed at any time before their death.

-

It is only for wealthy individuals.

Some think that only those with substantial assets should consider a Transfer-on-Death Deed. However, it can be beneficial for anyone who wishes to simplify the transfer of real estate to heirs.

Addressing these misconceptions can help individuals make better decisions regarding their estate planning and property management in Indiana.

Other Popular Indiana Templates

Indiana Bmv Forms - Confirms terms of sale, including payment and delivery details.

To further enhance your understanding of workplace policies and ensure you are well-informed, refer to the Company Handbook, which provides essential guidance for both employers and employees alike.

Indiana Residential Purchase Agreement - Provision for a title search is often included to ensure there are no liens on the property.

Indiana Special Warranty Deed Form - A deed is a legal document used to transfer property ownership.