Blank Small Estate Affidavit Form for the State of Indiana

Indiana Small Estate Affidavit Sample

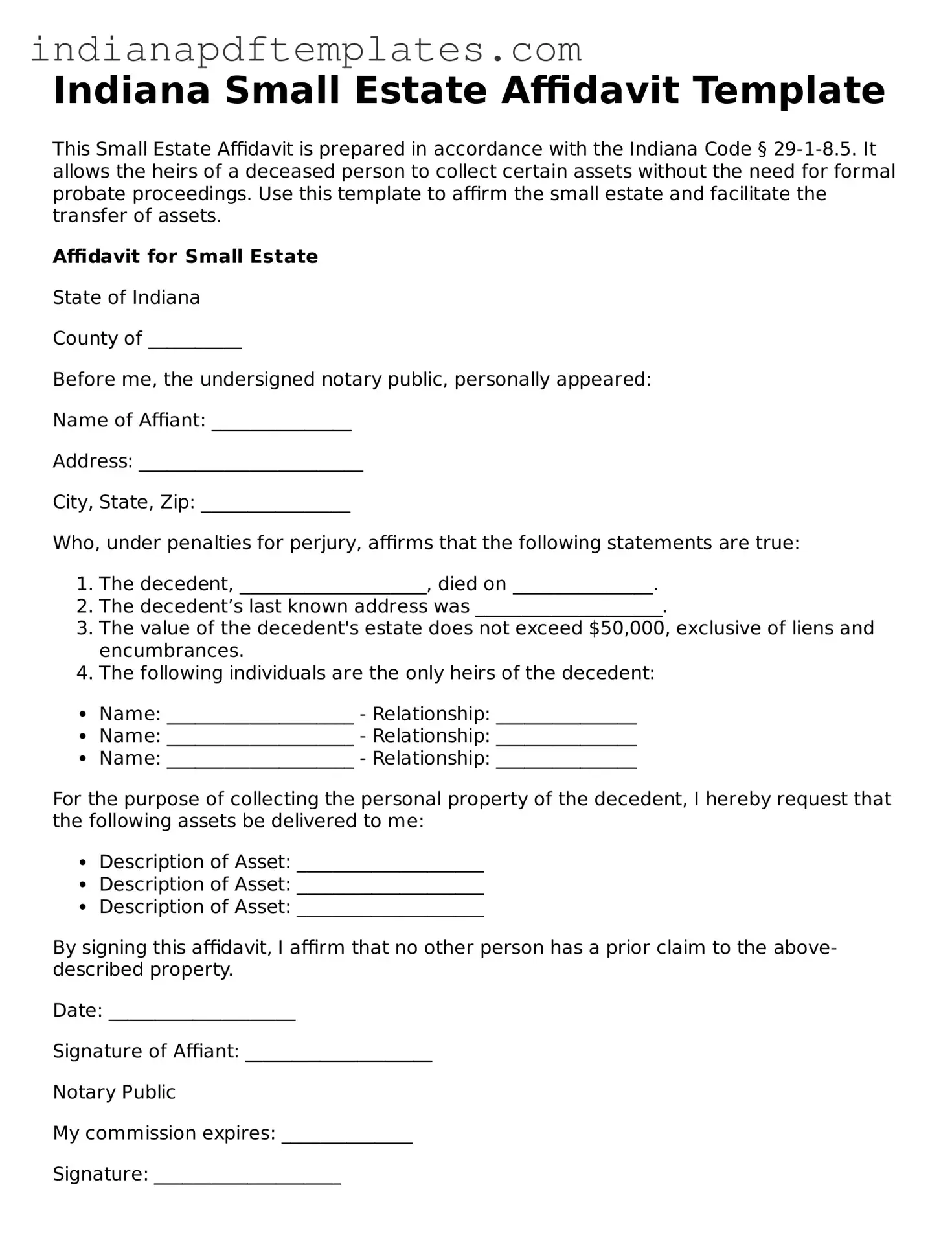

Indiana Small Estate Affidavit Template

This Small Estate Affidavit is prepared in accordance with the Indiana Code § 29-1-8.5. It allows the heirs of a deceased person to collect certain assets without the need for formal probate proceedings. Use this template to affirm the small estate and facilitate the transfer of assets.

Affidavit for Small Estate

State of Indiana

County of __________

Before me, the undersigned notary public, personally appeared:

Name of Affiant: _______________

Address: ________________________

City, State, Zip: ________________

Who, under penalties for perjury, affirms that the following statements are true:

- The decedent, ____________________, died on _______________.

- The decedent’s last known address was ____________________.

- The value of the decedent's estate does not exceed $50,000, exclusive of liens and encumbrances.

- The following individuals are the only heirs of the decedent:

- Name: ____________________ - Relationship: _______________

- Name: ____________________ - Relationship: _______________

- Name: ____________________ - Relationship: _______________

For the purpose of collecting the personal property of the decedent, I hereby request that the following assets be delivered to me:

- Description of Asset: ____________________

- Description of Asset: ____________________

- Description of Asset: ____________________

By signing this affidavit, I affirm that no other person has a prior claim to the above-described property.

Date: ____________________

Signature of Affiant: ____________________

Notary Public

My commission expires: ______________

Signature: ____________________

Instructions:

- All blanks must be filled in prior to submission.

- This affidavit must be signed in front of a notary public.

- Retain a copy for your records.

PDF Properties

| Fact Name | Description |

|---|---|

| Purpose | The Indiana Small Estate Affidavit allows heirs to claim assets of a deceased person without going through formal probate. |

| Eligibility | This affidavit can be used when the total value of the estate is less than $50,000, excluding certain exempt property. |

| Governing Law | The use of the Small Estate Affidavit is governed by Indiana Code § 29-1-8-1. |

| Filing Requirements | Heirs must provide a completed affidavit, a death certificate, and any necessary supporting documents to claim assets. |

| Signature Requirement | All heirs who are claiming assets must sign the affidavit to validate the claim. |

| Asset Types | Assets that can be claimed include bank accounts, personal property, and certain real estate, subject to value limits. |

| Timeframe | The affidavit must be filed within a reasonable time after the death of the individual, typically within a year. |

| Limitations | Some debts and obligations of the deceased may still need to be settled before assets can be distributed. |

| Legal Assistance | While legal assistance is not required, consulting an attorney can help ensure proper completion and filing of the affidavit. |

Essential Points on This Form

What is the Indiana Small Estate Affidavit form?

The Indiana Small Estate Affidavit is a legal document that allows individuals to settle the estate of a deceased person without going through formal probate proceedings. This process is typically simpler and faster, making it an efficient option for smaller estates. In Indiana, the Small Estate Affidavit can be used when the total value of the estate is less than $50,000 for personal property or $100,000 for real property.

Who can use the Small Estate Affidavit?

The Small Estate Affidavit can be utilized by the following individuals:

- The surviving spouse of the deceased.

- Any heir at law who is entitled to inherit under Indiana law.

- A person designated as the personal representative in the deceased's will.

It is important to note that all heirs must agree to use the Small Estate Affidavit process.

What information is required to complete the form?

To fill out the Indiana Small Estate Affidavit, you will need to provide several key pieces of information, including:

- The name and address of the deceased.

- The date of death.

- A list of assets, including their estimated values.

- The names and addresses of all heirs.

- A statement confirming that the total value of the estate is within the limits set by Indiana law.

Accurate information is crucial to ensure the affidavit is valid and accepted by financial institutions and other entities.

How is the Small Estate Affidavit filed?

Filing the Small Estate Affidavit involves a few steps:

- Complete the affidavit form with all required information.

- Have the form notarized to verify its authenticity.

- Submit the affidavit to the appropriate financial institutions or entities that hold the deceased’s assets.

No court filing is necessary, which helps streamline the process. However, it may be beneficial to keep a copy for personal records.

What happens after the affidavit is filed?

Once the Small Estate Affidavit is submitted, financial institutions and other entities will review the document. If everything is in order, they will release the assets to the heirs listed in the affidavit. The process can take varying amounts of time, depending on the institution's policies and the complexity of the estate. It is advisable for heirs to follow up with these institutions to ensure a smooth transfer of assets.

Misconceptions

Misconceptions about the Indiana Small Estate Affidavit can lead to confusion regarding the process of settling a small estate. Below are seven common misconceptions and clarifications about the form.

- Only estates under a certain value can use the affidavit. Many believe that only estates valued below a specific dollar amount qualify. However, the limit for using the Small Estate Affidavit in Indiana is $50,000 for personal property and $100,000 for real estate, which may be higher than some expect.

- The affidavit can be used for any type of asset. Some assume that the Small Estate Affidavit applies to all assets. In reality, it is primarily for personal property and does not cover certain assets like real estate or assets held in a trust.

- All heirs must agree to use the affidavit. It is a common belief that unanimous consent from all heirs is necessary. While it is important to inform heirs, only the person filing the affidavit needs to sign it, making the process simpler.

- The process is the same as probate. Some individuals think that using the Small Estate Affidavit is equivalent to going through probate. However, the affidavit is a simpler alternative to probate, designed to expedite the distribution of small estates.

- Filing the affidavit is a lengthy process. There is a misconception that completing and filing the Small Estate Affidavit takes a significant amount of time. In fact, it can often be completed relatively quickly, depending on the circumstances.

- Legal assistance is required to file the affidavit. Many people believe that hiring an attorney is mandatory. While legal assistance can be beneficial, individuals can complete and file the Small Estate Affidavit without professional help if they understand the requirements.

- The affidavit must be filed in court. Some think that the Small Estate Affidavit needs to be filed in a court. Instead, it is typically presented to the financial institutions or entities holding the deceased's assets, not filed in a court.

Other Popular Indiana Templates

Power of Attorney Form Indiana Pdf - A General Power of Attorney can be effective immediately or at a future date.

In addition to the essential details provided in the Texas RV Bill of Sale, it's important for both parties to have access to reliable templates to ensure accuracy and compliance with state regulations; resources like Fast PDF Templates can be very helpful in this regard.

Indiana Llc Requirements - This form encourages transparency and accountability among members.

Indiana Will Template - Can incorporate specific instructions regarding family heirlooms.