Printable Indiana M400 Form

Indiana M400 Sample

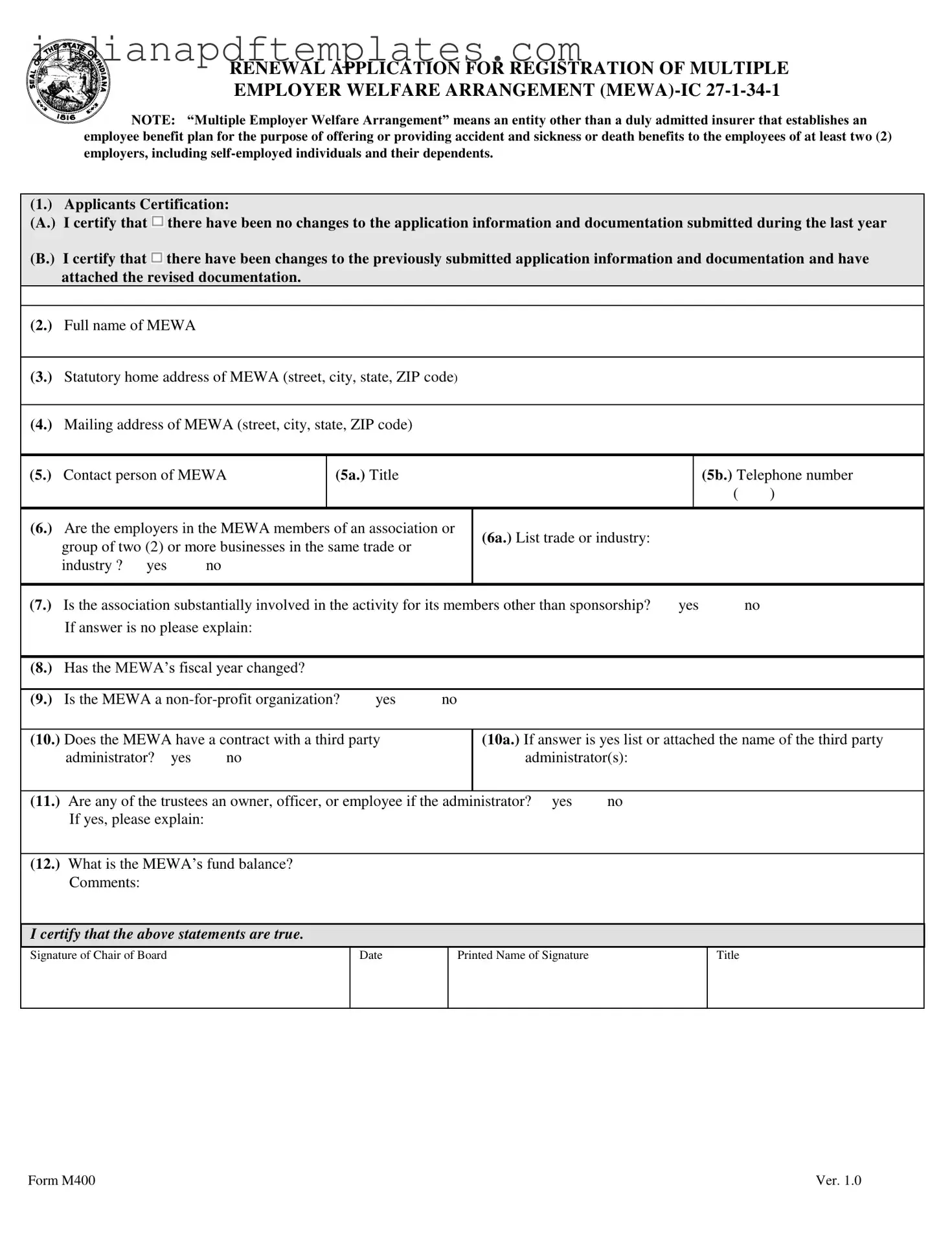

RENEWAL APPLICATION FOR REGISTRATION OF MULTIPLE

EMPLOYER WELFARE ARRANGEMENT

NOTE: “Multiple Employer Welfare Arrangement” means an entity other than a duly admitted insurer that establishes an employee benefit plan for the purpose of offering or providing accident and sickness or death benefits to the employees of at least two (2) employers, including

(1.) |

Applicants Certification: |

|

|

|

|

|

|

|

|

|

|

|||

(A.) |

I certify that |

there have been no changes to the application information and documentation submitted during the last year |

||||||||||||

|

|

|

|

|

|

|

|

|

||||||

(B.) |

I certify that |

there have been changes to the previously submitted application information and documentation and have |

||||||||||||

|

attached the revised documentation. |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(2.) |

Full name of MEWA |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||||

(3.) |

Statutory home address of MEWA (street, city, state, ZIP code) |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

(4.) |

Mailing address of MEWA (street, city, state, ZIP code) |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||

(5.) |

Contact person of MEWA |

(5a.) Title |

|

|

|

|

|

(5b.) Telephone number |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

(6.) |

Are the employers in the MEWA members of an association or |

(6a.) List trade or industry: |

|

|

|

|

||||||||

|

group of two (2) or more businesses in the same trade or |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||

|

industry ? |

yes |

|

no |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

(7.) |

Is the association substantially involved in the activity for its members other than sponsorship? |

yes |

no |

|||||||||||

|

If answer is no please explain: |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

(8.) |

Has the MEWA’s fiscal year changed? |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||

(9.) |

Is the MEWA a |

yes |

no |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||||||

(10.) Does the MEWA have a contract with a third party |

|

|

(10a.) If answer is yes list or attached the name of the third party |

|||||||||||

|

administrator? |

yes |

no |

|

|

|

|

administrator(s): |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||||

(11.) |

Are any of the trustees an owner, officer, or employee if the administrator? yes |

no |

|

|

|

|

||||||||

|

If yes, please explain: |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||

(12.) |

What is the MEWA’s fund balance? |

|

|

|

|

|

|

|

|

|

|

|||

|

Comments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

I certify that the above statements are true. |

|

|

|

|

|

|

|

|

|

|

||||

Signature of Chair of Board |

|

|

|

Date |

|

Printed Name of Signature |

|

|

|

Title |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form M400 |

Ver. 1.0 |

File Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Purpose | The Indiana M400 form is used for the renewal application for the registration of Multiple Employer Welfare Arrangements (MEWAs). |

| Governing Law | This form is governed by Indiana Code IC 27-1-34-1. |

| Applicant Certification | Applicants must certify whether there have been changes to the application information and documentation submitted in the previous year. |

| MEWA Definition | A Multiple Employer Welfare Arrangement is defined as an entity that provides employee benefit plans for at least two employers, including self-employed individuals. |

Essential Points on This Form

What is the Indiana M400 form?

The Indiana M400 form is a renewal application specifically designed for Multiple Employer Welfare Arrangements (MEWAs). A MEWA is an entity that provides employee benefit plans, such as accident and sickness or death benefits, to employees of at least two employers, including self-employed individuals. This form ensures that the MEWA remains compliant with state regulations.

Who needs to fill out the M400 form?

Any organization operating as a MEWA in Indiana must complete the M400 form when renewing their registration. This includes groups of employers, trade associations, and other entities that provide health benefits to employees from multiple businesses.

What information is required on the M400 form?

The M400 form requires several key pieces of information, including:

- The full name of the MEWA

- The statutory home address

- The mailing address

- Contact person details

- Information about the employers involved in the MEWA

- Details regarding any changes to the application information from the previous year

- Financial information, such as the MEWA’s fund balance

What does it mean to certify the application information?

By certifying the application information, the applicant confirms that the details provided are accurate and complete. If there have been changes to the previously submitted information, the applicant must attach the revised documentation. This certification is crucial for maintaining transparency and accountability.

Are there any specific questions related to the MEWA’s structure?

Yes, the M400 form includes questions about the MEWA's organizational structure, such as:

- Whether the employers in the MEWA are part of an association or group.

- If the association is actively involved in activities beyond mere sponsorship.

- Details about any third-party administrators and their relationship with the trustees.

These questions help regulators understand the MEWA's operations and governance.

What is the significance of the fund balance information?

The fund balance indicates the financial health of the MEWA. It reflects the total assets available to cover the benefits promised to members. Providing this information allows regulators to assess the MEWA's ability to fulfill its obligations to its members.

What happens if there are changes to the application information?

If there are changes to the previously submitted application information, the applicant must indicate this on the form and provide the revised documentation. This ensures that the information on record is current and accurate, which is essential for compliance and effective operation.

Is there a deadline for submitting the M400 form?

Can I get assistance with completing the M400 form?

Yes, assistance is available for completing the M400 form. Many organizations offer support services to help applicants understand the requirements and ensure that all necessary information is accurately provided. Seeking help can reduce the likelihood of errors and delays.

Misconceptions

- Misconception 1: The M400 form is only for large companies.

- Misconception 2: The M400 form is only for health insurance.

- Misconception 3: You can submit the M400 form without any changes every year.

- Misconception 4: The MEWA must be a for-profit organization.

- Misconception 5: You cannot change your MEWA’s fiscal year.

- Misconception 6: You don’t need to provide a contact person.

- Misconception 7: The M400 form can be submitted without a third-party administrator.

- Misconception 8: The M400 form is a one-time submission.

- Misconception 9: All trustees must be independent of the administrator.

This form is intended for any group of two or more employers, regardless of size. Small businesses can also benefit from it.

While the M400 relates to employee benefits, it can cover various types of benefits, not just health insurance.

If there are no changes to your information, you still need to certify that this is the case. This ensures that all records are current.

The M400 form can be used by non-profit organizations as well. This is an important option for many groups.

Changes to the fiscal year can be reported on the M400 form. It’s crucial to keep this information updated.

Every application must include a contact person. This helps streamline communication and clarifies responsibilities.

If your MEWA has a contract with a third-party administrator, this must be disclosed on the form.

This form must be renewed regularly. Annual updates ensure compliance and accuracy in your records.

While it’s preferred, it’s not a strict requirement. However, any potential conflicts of interest must be disclosed.

Find More Templates

Indiana Deer Hunting Hours - Participants are reminded that they assume all risks associated with hunting on private land.

To facilitate a smooth rental process, it is important for landlords and tenants to be well-acquainted with the Arizona Residential Lease Agreement, which can be accessed through this link: https://arizonapdfs.com/residential-lease-agreement-template. This document clearly defines the expectations and responsibilities of both parties, helping to prevent misunderstandings and ensuring compliance with state regulations.

Indiana 53421 - Answer the health screening questions honestly; this won't affect your eligibility.

Indiana State Fair Rules 2023 - Complete contact information is required for all exhibitors.