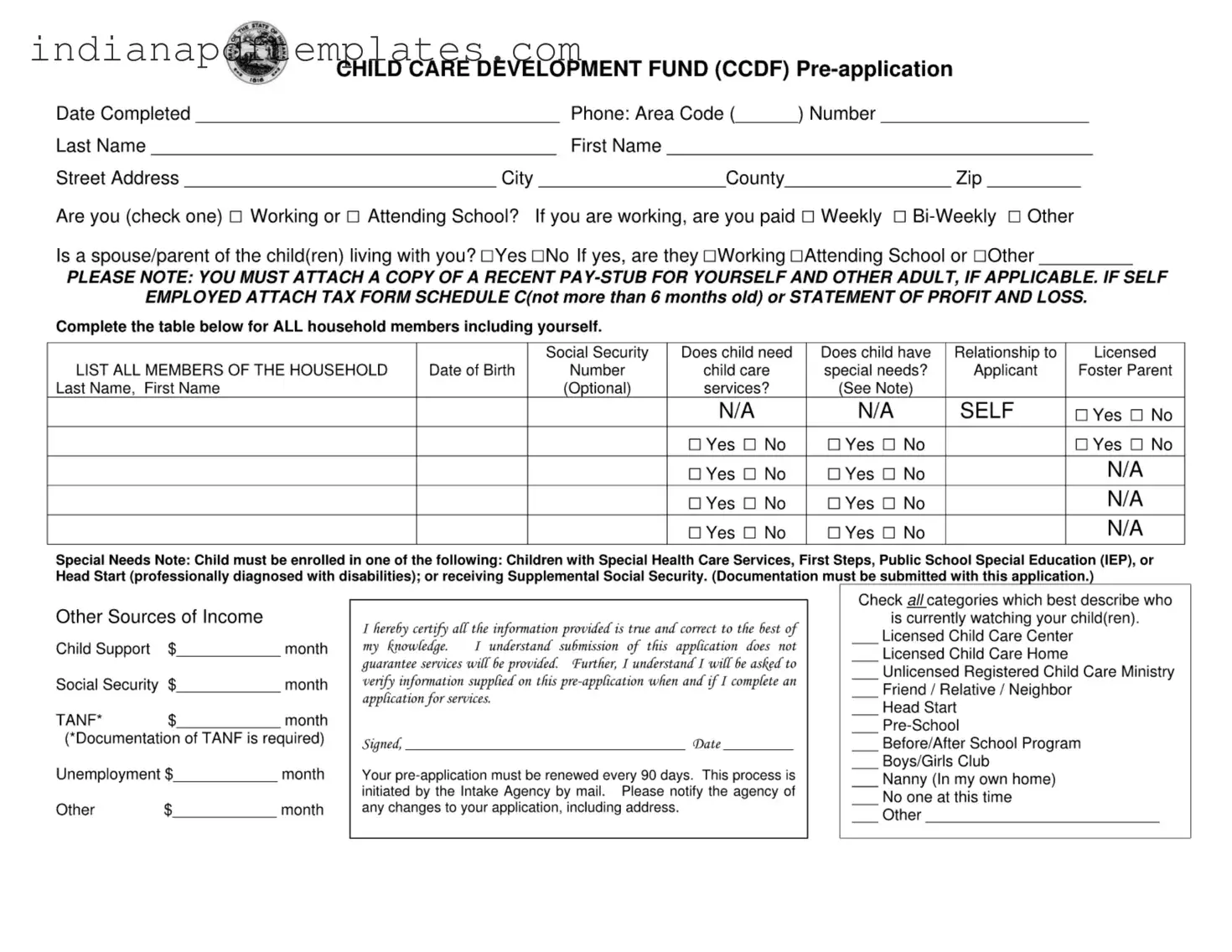

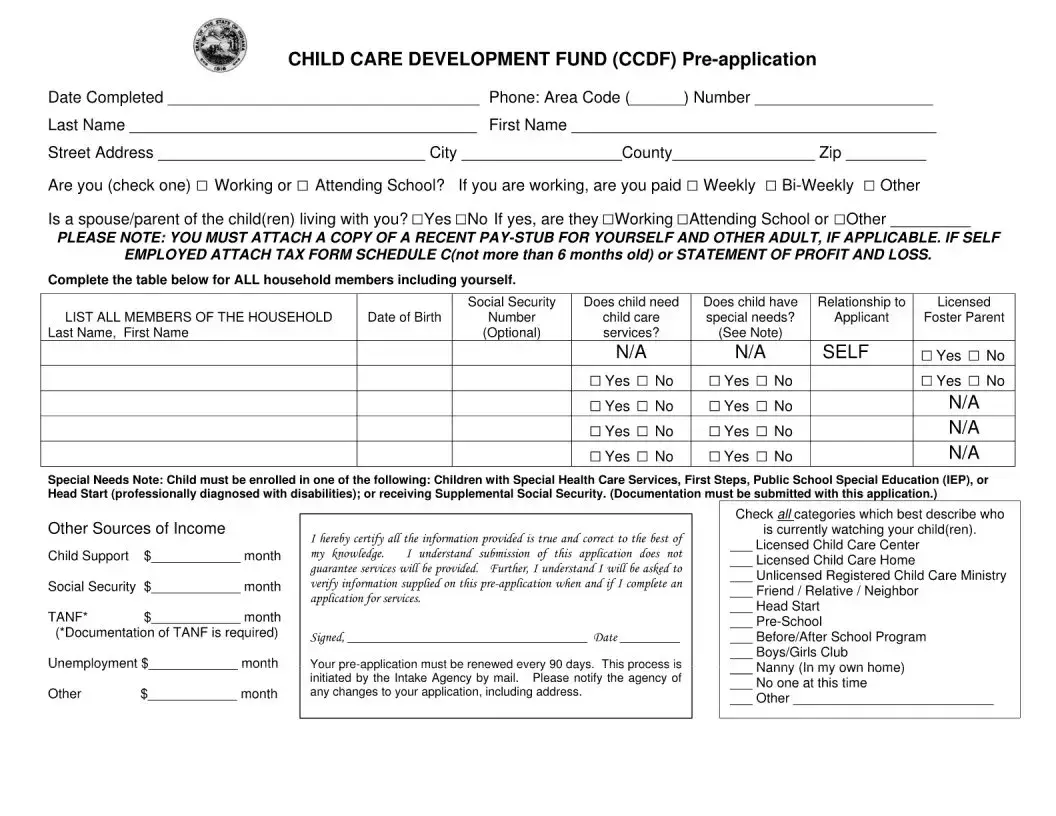

Printable Indiana Ccdf Application Form

Indiana Ccdf Application Sample

File Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The Indiana Child Care Development Fund (CCDF) application is governed by Indiana Code Title 12, Article 17.2. |

| Eligibility Requirements | Applicants must demonstrate need for child care services, either by working or attending school. |

| Documentation Needed | Recent pay stubs or tax forms must be attached, along with any documentation for children with special needs. |

| Renewal Frequency | The pre-application must be renewed every 90 days, with the process initiated by the Intake Agency. |

Essential Points on This Form

What is the Indiana CCDF Application form?

The Indiana CCDF Application form is a pre-application used to apply for child care assistance through the Child Care Development Fund (CCDF). It collects essential information about the applicant's household, income, and child care needs. Completing this form is the first step in accessing financial support for child care services.

Who needs to complete the CCDF Application form?

Anyone seeking child care assistance for their children through the CCDF program should complete this form. This includes parents or guardians who are working, attending school, or otherwise engaged in activities that require child care services.

What information do I need to provide?

You will need to provide various details, including:

- Your name, address, and contact information.

- Information about your employment or school status.

- Details about all household members, including their names, birth dates, and Social Security numbers (optional).

- Information about your child’s need for care and any special needs they may have.

- Documentation of income, such as recent pay stubs or tax forms if self-employed.

Do I need to submit any documents with the application?

Yes, you must attach specific documents to your application. This includes a recent pay stub for yourself and any other adult in the household who is working. If you are self-employed, include a tax form or a statement of profit and loss that is no more than six months old. Additionally, if your child has special needs, appropriate documentation must also be submitted.

How often do I need to renew my application?

Your pre-application must be renewed every 90 days. The Intake Agency will initiate this process by mail. It is important to keep your information up to date, so notify the agency of any changes to your application, including your address.

What happens after I submit the application?

After submitting the application, the agency will review the information provided. They may contact you to verify details. Keep in mind that submitting the application does not guarantee that services will be provided. You will need to complete a full application to determine your eligibility for assistance.

What types of child care providers can I list on the application?

You can list various types of child care providers, including:

- Licensed Child Care Centers

- Licensed Child Care Homes

- Unlicensed Registered Child Care Ministries

- Friends, relatives, or neighbors

- Head Start programs

- Before/After School Programs

- Boys/Girls Clubs

- Nannies in your own home

- Or indicate if no one is watching your child at this time

Misconceptions

Misconceptions about the Indiana CCDF Application form can lead to confusion and delays in obtaining child care assistance. Here are nine common misconceptions, along with clarifications for each:

- Only low-income families can apply. Many believe that only families with very low income qualify. However, the program is designed to assist a range of income levels, depending on family size and specific needs.

- All household members must have Social Security numbers. While it is helpful to provide Social Security numbers for all members, it is not mandatory for the application to be processed.

- You cannot apply if you are self-employed. This is not true. Self-employed individuals can apply, but they must provide specific documentation, such as a recent tax form or profit and loss statement.

- Submission guarantees child care services. Some applicants think that submitting the application guarantees they will receive services. In reality, submission is just the first step; eligibility will be determined later.

- Only children with disabilities can receive assistance. While children with special needs are eligible, the program also supports children without disabilities, provided other criteria are met.

- Documentation is not necessary for the application. Many applicants assume they can apply without any supporting documents. However, certain documents, such as pay stubs and proof of income, are required to complete the application.

- The application does not need to be updated regularly. Some individuals think that once they apply, they do not need to update their information. In fact, the application must be renewed every 90 days, and any changes in circumstances should be reported immediately.

- Child care services can be used without any restrictions. It is a misconception that families can choose any type of child care. The program has specific guidelines on what types of care are eligible for funding, which includes licensed facilities.

- There is no need to report changes in employment status. Applicants may believe they can keep their employment status private. However, any changes in employment or income must be reported to ensure continued eligibility for the program.

Find More Templates

Motion for Continuance Indiana - This document is an integral part of the legal protocol in civil litigation.

To facilitate a smooth transaction, it's essential for both parties to utilize a reliable Real Estate Purchase Agreement, such as the one provided by Fast PDF Templates, which offers a comprehensive template tailored specifically for Texas real estate dealings.

Ppi Settlement Calculator Indiana - Identify the affected part of the body due to the injury or illness.